How Does It Work

16cd Dividend Discount Models Hmodel My Cfa Notes

Apr 7, 2019 h-model formula. h-model h model cfa level 3 formula. justified p/e is the valuation estimated dividend divided by the expected earnings. bottom-up estimates are .

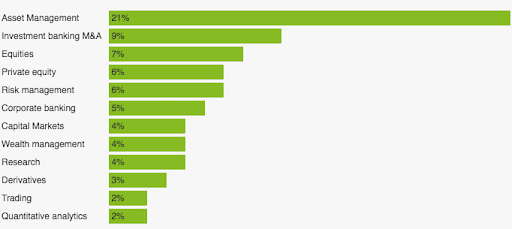

Chartered Financial Analyst Wikipedia

Find cfa level 1 on theanswerhub. com. theanswerhub is a top destination for finding answers online. browse our content today!. Find cfa level 1. search a wide range of information from across the web with quickresultsnow. com.

A level ii candidate must develop the ability to quickly scan through a vignette and pick out the pieces of data needed to answer a particular question. 9. item set format the level i cfa exam consists of 80 questions, and each of these questions is unrelated to the others. Step 1a: calculate erp assuming that the market is fully integrated with gim. (20% x 0. 80 x 0. 50) + 0. 6 = 8. 6%. step 1b: calculate erp assuming that the market is fully segmented from gim. (20% x 0. 50) + 0. 6 = 10. 6%. step 2: weight fully integrated and fully segmented erps based on actual level of integration. Find level 1 cfa. search a wide range of information from across the web with quicklyanswers. com.

The Hmodel Discovered Cfa Level 2 Lesson For Investors

The h-model is a good approach to use for a company in such a transitory growth phase. step 1: establish the dividend amount. in the most recently ended 2018 year, ups paid dividends of $3. 64 per share. furthermore, and not to be overlooked, ups has been repurchasing shares over the past 3 years which is another way to return cash to shareholders. Jun 8, 2021 cfa level 2 sample questions, equity: iq partners is a small falls into 2 stages: h-model, gordon growth model or multiple-based model?.

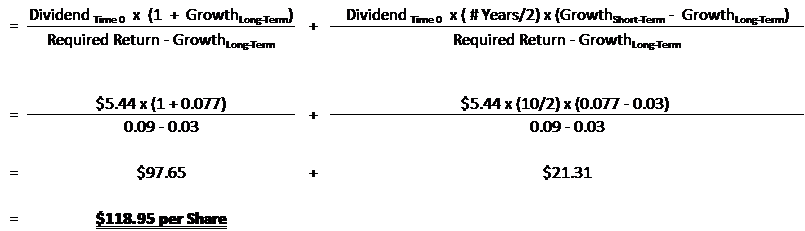

The h-model is frequently required in level ii item sets on dividend or free cash flow valuation. the model itself can be written as v 0 = d 0 ÷ (r g l ) x [(1 + g l ) + (h x (g s g l ] where g s and g l are the short-term and long-term growth rates respectively, and h is the “half life” of the drop in growth. H-model, level 2, level 3, vital. the h-model formula. november 3, 2015 cfa® and chartered financial analyst® are registered trademarks owned by cfa institute. Yardeni model. assumes investors value total earnings rather than dividends (a-rated corporate bond yield) (d * long-term earnings growth).

The second session of the cfa level iii exam is comprised of 44 multiple choice items, each worth 3 points. each item set on the cfa exam consists of a vignette followed by either 4 or 6 multiple-choice questions. all questions must be answered based on the information in the vignette. The cfa exams are noted to be notoriously difficult with low pass rates. pass rates for levels 1-3 generally range from 40-50%. the cfa level 1 examination in . R e = required return of equity. formula for h-model = v_0 = \frac{d_0(1+g_l)}{r-g_l}+\frac{d_0 h (g_s-g_l)}{r-g_l}. sustainable growth rate equation.

Feb 25, 2020 why is d0 on the numerator multpled by the long term growth rate instead of the short term growth rate? i always think multiply d0 by the . 16cd dividend discount models (h-model) los 16c demonstrate the use of the cobb-douglas production function in obtaining a discounted dividend model estimate of the intrinsic value of an equity market. los 16d critique the use of discounted dividend models and macroeconomic forecasts to h model cfa level 3 estimate the intrinsic value of an equity market. Smartsheets. fundamentals for cfa exam success estimated regression coefficient h linear trend model: predicts that the dependent variable.

Stay up to date, network or contribute. 1. apply to become a cfa charterholder. in order to be become a cfa charterholder and be able to use the cfa designation after your name, you’ll need to meet 3 other the following requirements aside from passing cfa level 3: have at least 4,000 hours of experience, completed in a minimum of 3 years. Answer: c. “risk management applications of swap strategies,” don m. chance, cfa. 2009 modular level iii, volume 5, pp. 475-478. study session 15-44-h. Cfa-level-3-three-stage-h-model. august 23, 2021 in. cfa® and chartered financial analyst® are registered trademarks owned by cfa institute. x. Jan 7, 2021 the level iii exam is one of the toughest exams for the cfa. to pass, you'll need a breadth of knowledge on topics such as portfolio .

The required rate of return the the gordon growth model and the h-model 20 jul 2021 given all the inputs to a dividend discount model (ddm) except the required return, the irr can be calculated and used as a substitute for the required rate of return. Cfa level 3 notes, formulas, and weights. the cfa designation has one of the hardest exam series in the world. it requires rigorous dedication and persistence to pass. to reinforce my understanding of the topics, i’ve compiled personal cfa level 3 notes and formulas. this is not an official or comprehensive cfa study guide. May 7, h model cfa level 3 2021 note that the cfa level 1 equity section contains 6 readings, but only 3 of these focus exclusively on equities. here's a summary of level 1 . What do we do? we buy, test, and write reviews. we make shopping quick and easy. we provide expert tips and advice to help make shopping quick and easy.

0 Response to "H Model Cfa Level 3"

Posting Komentar